Where Have All the Metals

Gone?

L. David Roper

Department of Physics

Virginia Polytechnic

Institute and State University

Blacksburg, Virginia

24060-0435

roperld@vt.edu

1976

TABLE OF CONTENTS

Tables

Figures

Preface

Chapter 1: The Minerals Crisis

CHAPTER 2: Highly Depleted

United States Metals

Gold

Platinum Group

Mercury

Manganese Ore

Chromite

Silver

Lead

Cadmium

Zinc

Tin

Beryl

Niobium‑tantalum

CHAPTER 3: Moderately

Depleted United States Metals

Tungsten Ore

Selenium

Tellurium

Iron Ore

Bauxite

Titanium (Rutile)

Titanium (Ilmenite)

Vanadium

Nickel

CHAPTER 4: Depletion of

United States Mineral Fuels

Crude Oil

Natural Gas

Coal

CHAPTER 5: Overview of United

States Metals and Mineral‑Fuels Depletion

CHAPTER 6: Possible Futures

for the United States

Energy

Materials

Population

References

Tables

Table 1. United States mineral reserves and identified resources

Table 2. Depletion parameters for highly depleted United States metals

Table 3. Asymmetry classes for United States metals production data

Table 4. Depletion parameters for moderately depleted United States metals

Table 5. Depletion parameters for United States mineral fuels

Table 6. United States metals and mineral-fuels depletion parameters

Table 7. United States minerals production and consumption percentages

Figures

Figure 1. World energy use rate versus time for exponential growth.

Figure 2 Gold production data, fits and predictions.

Figure 3 Platinum group production data, fits and predictions.

Figure 4. Mercury production data, fit and prediction.

Figure 5. Manganese ore production data, fits and predications.

Figure 6. Chromite production data, fit, and prediction.

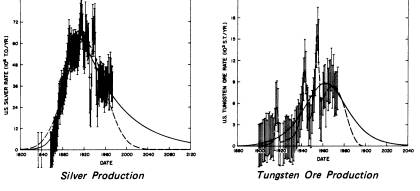

Figure 7. Silver production data, fits and predications.

Figure 8. Lead production data, fits and predictions.

Figure 9. Cadmium production data, fits and predictions.

Figure 10. Zinc production data, fits and predictions.

Figure 11. Tungsten Ore production data, fits and predictions.

Figure 12. Selenium production data, fit, and predictions.

Figure 13. Tellurium production data, fits and predictions.

Figure 14. Iron Ore production data, fits and predctions.

Figure 15. Bauxite production data, fits and predictions.

Figure 16. Titanium (futile) production data, fits and predictions.

Figure 17. Titanium (ilmenite) production data, fits and predictions

Figure 18. Vanadium production data, fits and predictions.

Figure 19. Nickel production data, fits and predictions.

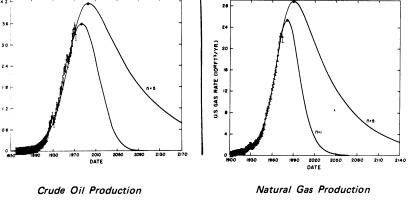

Figure 20. Crude‑Oil production data, fits and predictions.

Figure 21. Predicted crude‑oil peak date as a function of data‑cutoff date.

Figure 22. Comparison of crude‑oil predictions for different data‑cutoff dates.

Figure 23. Natural‑gas production data, fits and predictions.

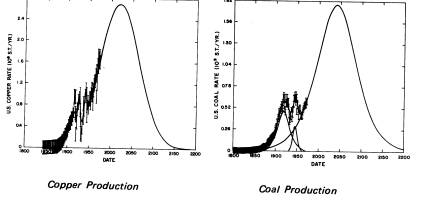

Figure 24. Coal production data, fits and predictions.

Figure 25. United States metals and mineral fuels peak dates.

Figure 26. United States minerals import and recycle percentages.

Figure 27. Exponential extrapolation of world population

Figure 28. Fits to world population.

Preface

This book is an interpretation and a simplification for a general audience of recently published metals and minerals-fuels depletion research by Dr. Richard A. Arndt and myself.* While teaching a university course on energy, I became uneasy about the methods authors of books and journal articles on energy were using to estimate the future availability of mineral fuels (crude oil, natural gas, and coal). Some were extrapolating present production rates into the far distant future while others assumed that recent exponential growth in production rates would continue into the far distant future. Both methods are obviously wrong. Some authors have more realistically assumed that production-rate growth must eventually slow, stop, and then production rate will begin to decline as the mineral becomes harder to extract from the earth, i.e., as more energy and materials are required and more environmental degradation occurs in the extraction process.

But even in the realistic projections it was usually not obvious how the authors had arrived at their predictions. Some had used reserves estimates to delimit the amount of the mineral that would eventually be extracted. Since reserves estimates are notoriously variable depending on the methods of estimation, time of estimation, and the estimator; I was not satisfied with this approach either. It appeared to me that the best method is to fit the yearly production‑rate data with mathematical functions of time that have the kind of behavior that realism requires, namely that the production rate must rapidly rise (probably exponentially), eventually peak, and then fall (but probably not so rapidly as the original rise) asymptotically until the mineral is effectively depleted. It was not clear to me then that anyone had actually fitted production‑rate data by means of standard statistical least‑square‑fit procedures, although Hubbert had for crude oil and natural gas. Being of independent minds, my colleague, Dr. Richard A. Arndt, and I used his highly refined computer least‑square‑fit code to fit United States oil and gas production‑rate data.

The results of the oil and gas fits whetted our appetites and thus led us to fit United States metals production‑rates data and finally the world metals and mineral fuels production‑rates data.

Having originally had very little knowledge about minerals depletion, we were greatly surprised to find that approximately three‑fourths of the metals have apparently already peaked in production rate in the United States and one‑fourth of the world metals have peaked. On the other hand, neither oil nor gas have peaked for either the United States or the world, although oil and gas will peak very soon for the United States.

Some minerals specialists have regularly warned, beginning at east twenty‑five years ago, that the United States was rapidly approaching a minerals‑depletion crisis. The United States public has finally been shocked into accepting this fact for oil and gas, thanks to some timely help from the Arabian oil producers. The fact that the United States is in a much more severe, in terms of production rates, metals “crisis” than it is in a mineral‑fuels crisis has not yet registered with the average citizen. And there does not appear to be a sudden shocker on the horizon to apprise the American public of this fact because the world metals producers are not so strongly bound to concerted action by religion, conflict, or geography as are the world oil producers. So perhaps it would be more faithful to the English language to use the term “metals‑depletion problem” instead of “metals crisis” at least until the general public recognizes the severity of the problem.

There is perhaps another reason, besides the one given above, why the metals‑depletion problem has not registered in the public mind as much as the mineral‑fuels depletion problem has. The crucial importance of energy to all motions and transformations of matter, including mining and processing of metals, and the lack of a wide variety of mineral fuels and other presently available energy substitutes make the early stages of mineral‑fuels depletion much more traumatic than similar stages of metals depletion.

The current economic malaise in the United States, which must be strongly linked to decreasing production rates of metals in the United States, would not be easily connected in the public mind to the metals‑depletion problem even if the public knew about the problem. I hope that this book will make some small contribution toward making the general public aware of the metals‑depletion problem and that some public spirited economists or economic geologists will spend some effort at ferreting out, in terms the layman can understand, the connections between the metals depletion problem and the economic difficulties.

The author is grateful for the constant encouragement and help of Dr. Madan Gupta and for the help of Dr. Selim Sancactar in collecting the data.

* The

mathematical details of the theory involved and the data used in carrying out

this research are in Depletion of United

States and World Mineral Resources.

An abbreviated version of this research is available in paperback form, The Metals and Mineral Fuels Crises, Facts

and Predictions. Both are published

by University Publications, Blacksburg VA.

L.

David Roper

SUMMARY

An

analysis of United States minerals production data has shown that at least

fifteen metals have already peaked in production. The monetary metals silver

and gold peaked in 1908 and 1916, respectively, in the two‑decade period

before the onset of the Great Depression. More than five of the other metals

(probably including iron ore) peaked in the two‑decade period before

1975. Examples of silver and tungsten ore are shown in the figures.

|

|

It is seen that silver

production is skewed toward large times, as are all the metals except gold that

are far past peaking. The mineral fuels crude oil and natural gas are very near

their peaks as shown in the figures.

Therefore, it is too soon to tell how much

asymmetry they will eventually have. The figures above show predictions for two

cases, namely the symmetric case (n=1) and a reasonably asymmetric case (n=5).

|

|

Predictions of future production of minerals that have not peaked yet

is an uncertain endeavor. Tentative predictions for copper and coal are shown

in the figures.

|

|

The fact that most metals have already peaked

in production in the United States is consistent with the fact that most metals

are more than fifty percent imported.