The blue curve is the extraction-rate prediction. Note that, on the average, peak gas will occur at about 2015.

L. David Roper

http://www.roperld.com/personal/RoperLDavid.htm

02-Jul-2016

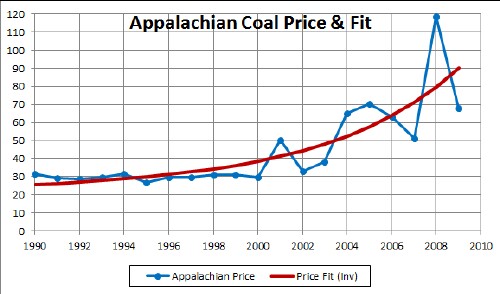

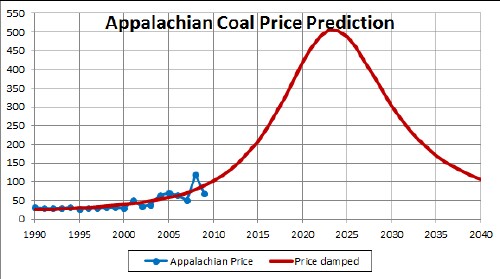

It seems reasonable that the price of a non-renewable mineral will be an inverse power function of the amount left to be extracted (Q). I did such a fit to the price of Appalachian coal since 1978 as shown below.

The amount of crude oil left to be extracted as a function of time, Q, for my best fit to the World extraction data & the discovery rate is given by the red curve here:

The blue curve is the extraction-rate prediction. Note that, on the average, peak gas will occur at about 2015.

I use Appalachian coal prices as a proxy for world coal prices.

The average price data fitted by a inverse power function of Q:

The equation of the curve is P =20.3+ (3.17x103)/Q28.6.

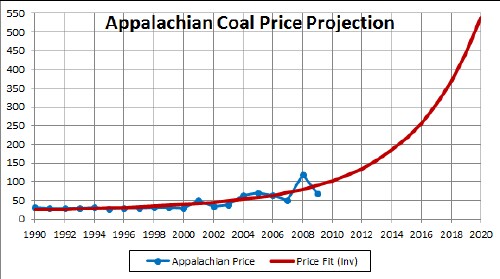

The prediction of the inverse-function fit for years up to 2020 is:

I expect that there will be fluctuations around the average curve, especially as panic sets in.

Each year as the last year's price is known, I can refit the curve to get a better prediction for future years.

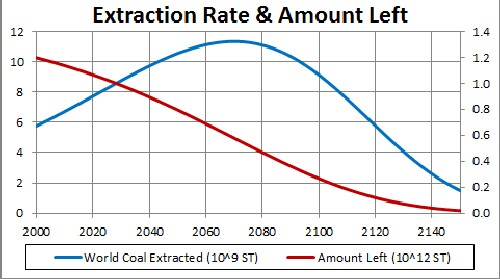

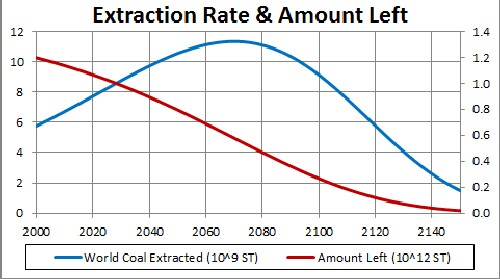

Probably when world coal extraction falls to about 1/2 of its peak, it will be realized by the market that we have to wean ourselves from oil. Renewable sources of energy and petroleum-like chemicals will replace oil. A possible scenario might be:

Such damping may also be influenced by the increase of electric transportation.

This curve was obtained by multiplying the function above by [1+tanh({t-2025}/5)]/2. I call this damping of natural-gas prices.

L. David Roper interdisciplinary studies

L. David Roper, http://arts.bev.net/RoperLDavid/; roperld@vt.edu