(Back to

Politics)

(Back to Economy and Political

Parties)

The presidential candidates in the 2000 election talked unceasing about what to do with the "surplus" that now "exists" and is projected for the future years. One can find these "surpluses" for several years and the projections for future years at http://w3.access.gpo.gov/usbudget/fy2000/pdf/hist.pdf .

In all of these pronouncements I never once heard the Republican candidate mention the huge federal debt. The Democratic candidate stated that he would set aside a certain fraction of the "surplus" to pay on the debt.

All reasonable persons would not say they had a real income surplus when their income exceeded their expenditures if they also had a huge debt. Similarly, we should not proclaim that the federal government has a real income surplus when the federal debt greatly exceeds the so-called surplus. The federal debt for past years can be found at http://www.publicdebt.treas.gov/opd/opd.htm#history . The interest expense on the federal debt since 1988 can be found at http://www.publicdebt.treas.gov/opd/opdint.htm.

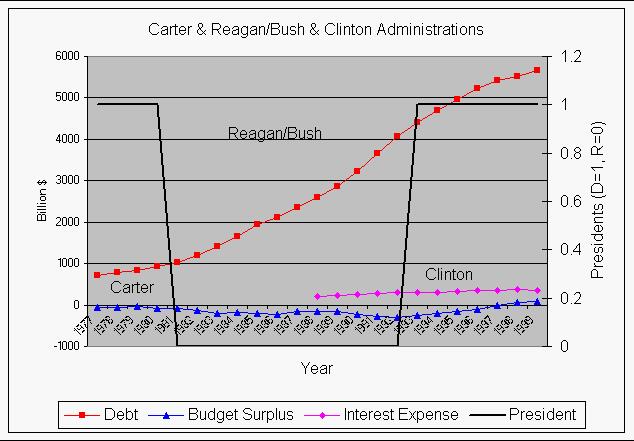

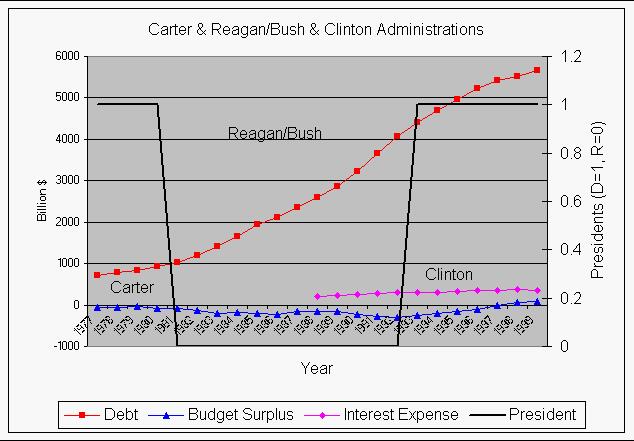

The figure below shows the federal debt, the federal surplus/deficit and the interest on the federal debt for the Carter, Reagan/Bush and the Clinton administrations. Note that the federal debt is huge compared to the minuscule surpluses in recent years and just the interest on the federal debt is several times larger than the much-lauded surpluses.

|

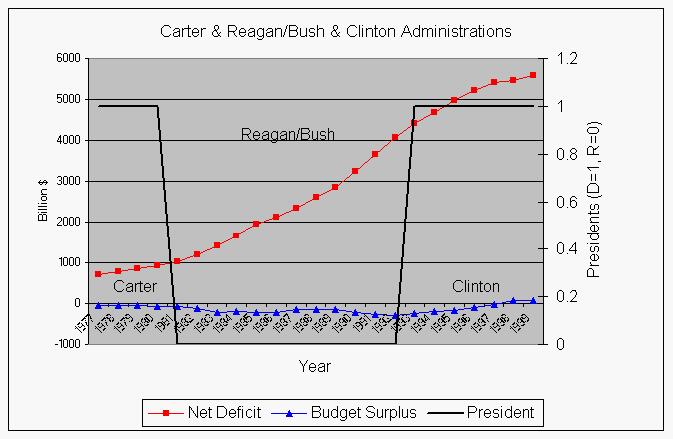

The figure below shows what I call the Net Deficit for each year, obtained by subtracting any so-called surplus from the federal debt, for the Carter, Reagan/Bush and the Clinton administrations. It is equal to the federal debt during the Carter and the Reagan/Bush years and has finally gone slightly below the debt in the last two Clinton Years because of a small "surplus". It appears that it will also for this year (2000).

|

Thus, it is misleading to speak of a federal "surplus". It would better represent our nations cash situation by instead referring to the Net Deficit.

We should not be considering large tax cuts or new huge spending programs before we strongly consider reducing the federal debt.

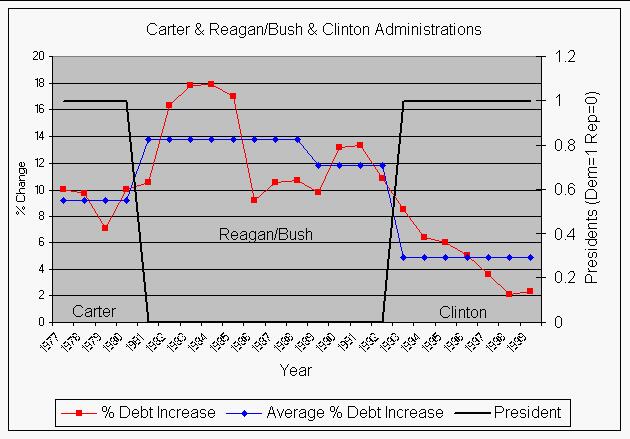

The following table shows the % federal debt increase for each year and the average yearly increase during the separate Carter, Reagan, Bush and Clinton administrations. It clearly points out the abysmal record of the Reagan/Bush administrations compared to the Clinton administration, and even to the Carter administration. Mr. Reagan instituted large tax cuts without reducing expenditures. Note that the federal debt increased every year even during the Clinton administration, although its rate of increase decreased.

|

The Republican candidate for president in the 2000 election proposed doing similar things to what Reagan did in his administration. Let's hope not!