Does Republican Control Guarantee More

Recession?

Letter to Editor of The Roanoke Times 8 Nov

2002

Dear Editor: The author of the commentary "Give the GOP a chance to govern" in the 1 November Roanoke Times needs to study economic variables as functions of presidential and party control of the national government. I have done such a detailed study and have found that for most such variables Democratic control has done better or much better than Republican control since the Franklin Roosevelt administration through the Clinton administration. The George W. Bush administration is adding to that trend.

For example, business-cycle expansion times (See http://www.nber.org/cycles.html) averaged 11 months per year for Democratic presidents and 9.6 months per year for Republican presidents. Even more revealing is the fact that business-cycle contraction times averaged only 1.1 months per year for Democratic presidents and 3 months per year for Republican presidents. Democratic presidents had 6 years with contractions out of 28 years in power and Republican presidents had 14 years with contractions out of 28 years in power.

When one looks at a measure of Democratic control of the national government (accounting for both president and congress) one gets a sizeable positive correlation of that control with large expansion times and essentially zero correlation of that control with large contraction times. Of course, the same type of Republican control measure gives the same value but negative correlation of that control with large expansion times.

Further details are available at http://arts.bev.net/roperldavid/politics/BusCycles.htm.

We are now in a contraction that we would like to turn into an another long expansion such as the last one, which lasted 120 months. Democratic control or Republican control usually played no role in halting contractions in the past; but Democatic control usually played a big role in making expansions last.

However, Democratic presidential control has usually played an important role both in reducing contraction time and increasing expansion time. It's time for a regime change at home. Yours, L. David Roper

An economics professor replied to my letter with the following points:

I made several e-mail replies to the Reply letter:

I agree with him on several points:

One statement of his is certainly not correct. He said "We are not in a contraction now." All one has to do to answer this is look at http://www.nber.org/cycles/november2001, which states "The NBER's Business Cycle Dating Committee has determined that a peak in business activity occurred in the U.S. economy in March 2001. A peak marks the end of an expansion and the beginning of a recession. The determination of a peak date in March is thus a determination that the expansion that began in March 1991 ended in March 2001 and a recession began. The expansion lasted exactly 10 years, the longest in the NBER's chronology."

I should have mentioned that the positive correlation of Democratic control with business-cycles expansion is only one of many sociological factors that positively correlate with Democratic control. I invite (the reply's author) and others to study many I have calculated at http://arts.bev.net/roperldavid/politics/economy.htm and http://arts.bev.net/roperldavid/politics/USHealth.htm.

I also invite (the reply's author) and others to calculate correlations of party control with any other sociological factors that I may have missed to add to the knowledge of whether any one party control of the national government is overwhelmingly more positive than the other.

This letter was not published by the Roanoke Times, so I sent a copy of it to the reply's author.

There were several e-mail exchanges with between the reply's author and me with the following points discussed:

I suspect that NBER is worried about the possibility of a "double-dip" recession. (See http://www.csmonitor.com/2002/0725/p01s02-usec.html. There are many other web pages about economists worried about the possibility of a double-dip recession.) It may also be worried about the possible effect on the economy of a ~$200x109 war/aftermath in and around Iraq that Bush is pushing.

Here is what NBER says that it uses to determine the troughs and peaks:

Here is an interesting comment about GDP and recessions on the NBER web

site (http://www.nber.org/cycles/november2001):

Q:

The financial press often states the definition of a recession as two

consecutive quarters of decline in real GDP. How does that relate to the NBER's

recession dating procedure?

A: Most of the recessions identified by our

procedures do consist of two or more quarters of declining real GDP, but not

all of them. But our procedure differs in a number of ways. First, we use

monthly indicators to arrive at a monthly chronology. Second, we use indicators

subject to much less frequent revision. Third, we consider the depth of the

decline in economic activity. Recall that our definition includes the phrase,

"a significant decline in activity."

Here are some interesting comments about employment and

recessions:

Q: How do structural changes in the economy in the 1990s affect

the NBER's method for dating business cycles? The Bureau notes that industrial

production measures a declining part of the economy. What other substitutes for

output bear watching, particularly with regard to service sector

activity?

A: Economy-wide employment and real personal income are the

most important monthly indicators. At a quarterly frequency, real GDP is

informative. Another interesting monthly indicator is aggregate hours of

work.

Q: Regarding movements of income as an indicator of recessions, isn't

it true that real income has not fallen substantially during five of the past

nine recessions.

A: That is why employment is probably the single most

reliable indicator.

So the business-cycle experts say that GDP is not the indicator to watch; employment is a much better indicator.

The unemployment-rate numbers in http://www.economagic.com/em-cgi/data.exe/fedstl/unrate+2 are:

| Year | Month | Unemployment Rate |

Year | Month | Unemployment Rate |

| 2001 | 01 | 4.2 | 2002 | 01 | 5.6 |

| 2001 | 02 | 4.2 | 2002 | 02 | 5.5 |

| 2001 | 03 | 4.3 | 2002 | 03 | 5.7 |

| 2001 | 04 | 4.5 | 2002 | 04 | 6.0 |

| 2001 | 05 | 4.4 | 2002 | 05 | 5.8 |

| 2001 | 06 | 4.6 | 2002 | 06 | 5.9 |

| 2001 | 07 | 4.6 | 2002 | 07 | 5.9 |

| 2001 | 08 | 4.9 | 2002 | 08 | 5.7 |

| 2001 | 09 | 5.0 | 2002 | 09 | 5.6 |

| 2001 | 10 | 5.4 | 2002 | 10 | 5.7 |

| 2002 | 11 | 5.6 | 2002 | 11 | 6.0 |

| 2002 | 12 | 5.8 | 2002 | 12 |

These numbers are not very encouraging for an expansion.

It was stated in the article in the Roanoke Times: "Perhaps the most misleading statement made by Roper is that '...Republican presidents had 14 years with contractions out of 28 in power.' The truth is that in 28 years, the eight 'Republican recessions' totaled 6.5 years in duration..."

Ok, let's compare the expansion and contraction times for Democratic and Republican years in months instead of in years: In the 28 years of Republican administrations there were 258 months of expansion and 78 months of contraction, while in the 28 years of Democratic administrations there were 304 months of expansion and 32 months of contraction. Thus, we have the following ratios for monthly numbers:

| Dem Expansion/Rep Expansion=1.18 | Rep Contraction/Dem Contraction=2.43 |

| Dem Expansion/Dem Contraction=9.5 | Rep Expansion/Rep Contraction=8.1 |

The yearly numbers give:

| Dem Expansion/Rep Expansion=1.04 | Rep Contraction/Dem Contraction=2.33 |

| Dem Expansion/Dem Contraction=4.7 | Rep Expansion/Rep Contraction=1.9 |

Another way to look at is by yearly averages for the 28 years of both parties:

| Dem Expansion=10.9 months/year | Rep Expansion=9.6 months/year |

| Dem Contraction=1.1 months/year | Rep Contraction=2.8 months/year |

By any measure one sees that Democratic administrations fared much better than Republican ones did, especially for contractions.

I recognize that the reply's author does not favor much governmental tinkering with the economy. However, I feel that the Democratic tendency to do more of that than the Republicans is what keeps the business cycles under better control under Democrats.

With regard to the author's comments about bipartisan control of the government, I have looked at that in my web pages: http://www.arts.bev.net/roperldavid/politics/buscycles.htm and http://www.arts.bev.net/roperldavid/politics/partycontrol.htm. The result is that correlations are generally better for the Democratic-control index than they are for the bipartisan-control index.

The author implys in his article that business cycle fluctuations are no more controllable than world wars. I just do not believe that.

In addition to business cycles versus politcal-party control, I have also looked at other economic variables. The results are at http://arts.bev.net/roperldavid/politics/economy.htm.

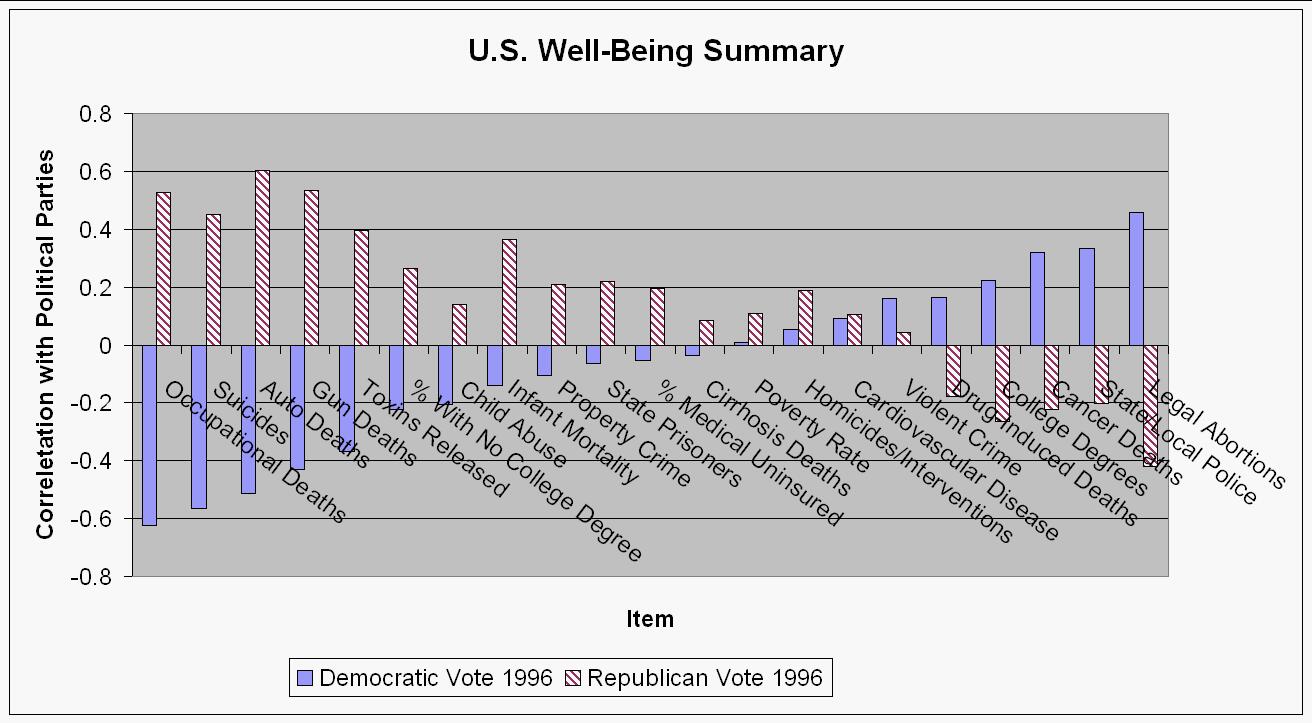

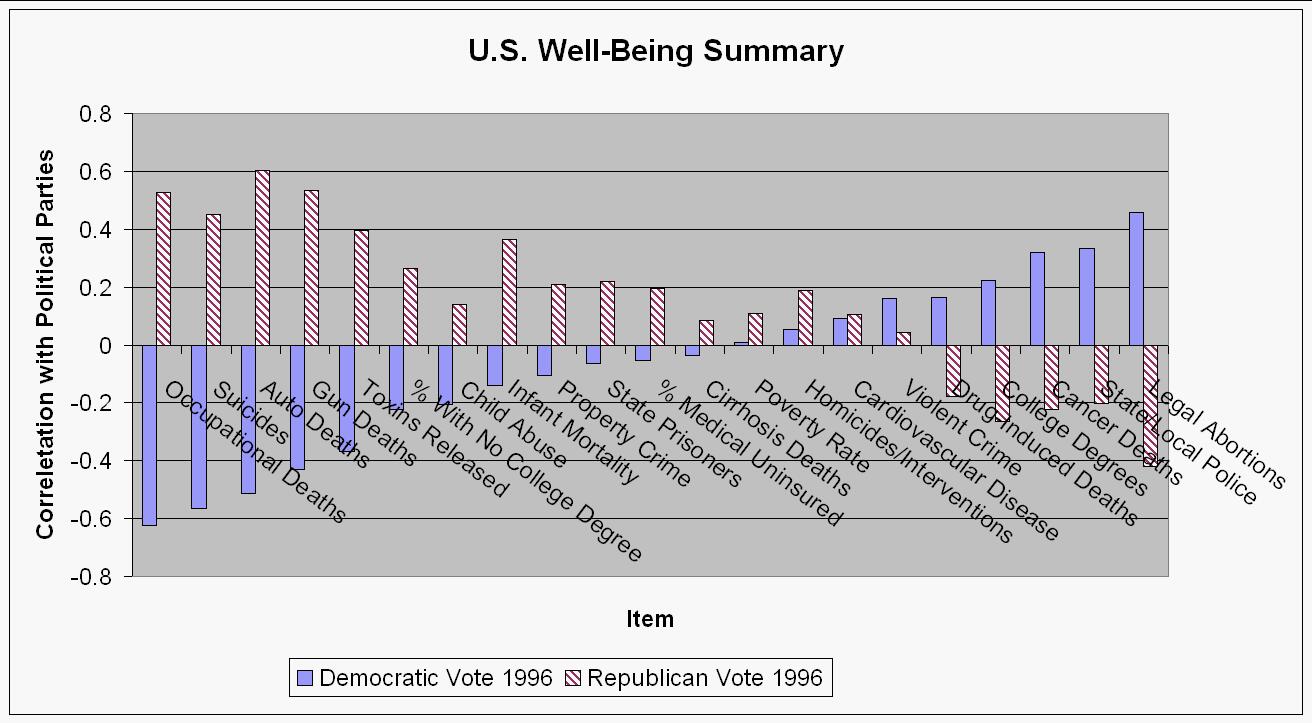

In additional to economic varables I have looked at many other sociological variables and calculated correlation coefficients with the Democratic and Republican candidates votes in the 1996 election for all states in the USA. (http://arts.bev.net/roperldavid/politics/USHealth.htm.) The Democratic-voting states correlate much better with sociological health than do the Republican-voting states. (E.g., death rates correlate -0.071 for DVS and +0.250 for RVS.) The following graph compares the correlations for the many different variables studied.